Creating a title loan amortization schedule by hand is a powerful way to manage your loan effectively. Start by calculating the total loan amount plus interest rates and fees, then determine the short-term loan term and divide by payment frequency. Each payment includes principal and interest. By keeping your vehicle as collateral, you streamline the process. This approach gives you control over repayments, ensuring timely payments and peace of mind. Visualize progress with a table tracking each period's payment amounts, principal repaid, interest paid, and remaining balance.

“Unraveling the process of creating a title loan amortization schedule by hand can seem daunting, but it’s a valuable skill to have. This comprehensive guide breaks down the intricate calculations into digestible steps, ensuring you understand how your loan repayment works. From comprehending the underlying principles to manually tracking interest reduction, each stage is thoroughly explained. By the end, you’ll learn to create an amortization schedule that visualizes your repayment journey, empowering you with knowledge and control over your title loan.”

- Understanding Title Loan Amortization: A Step-by-Step Guide

- Manual Calculation Process: From Principle to Interest Reduction

- Creating the Schedule: Visualizing Your Repayment Journey

Understanding Title Loan Amortization: A Step-by-Step Guide

Creating a Title Loan Amortization Schedule by Hand can seem daunting, but it’s a crucial skill to have for managing your loan effectively. Title loan amortization refers to the process of paying off a loan in regular installments over time, ensuring that both principal and interest are covered. This step-by-step guide will help you understand how it works and allow you to create your own schedule with ease.

First, calculate the total loan amount plus interest rates and fees. This forms the base for your amortization table. Next, determine the loan term, which is typically short-term, offering quick funding for your needs. Divide the total amount by the number of payments you’ll make during the loan term. This results in each payment’s principal and interest breakdown. Remember, keeping your vehicle as collateral makes this process smoother, ensuring a more straightforward repayment journey. You can then construct your amortization schedule, listing each payment with its respective portion for principal and interest. By following these steps, you gain control over your title loan amortization, enabling timely repayments and peace of mind.

Manual Calculation Process: From Principle to Interest Reduction

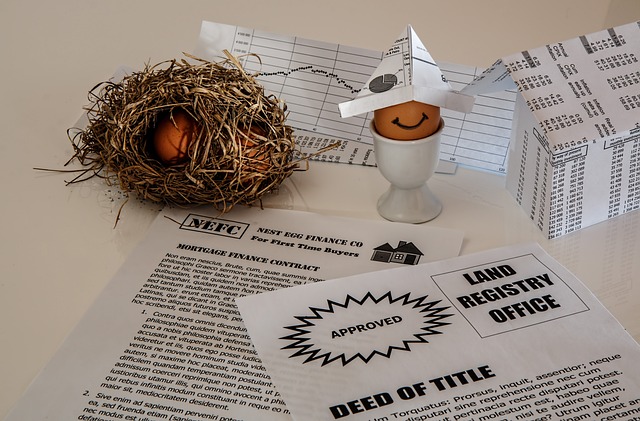

Creating a title loan amortization schedule by hand involves breaking down the complex process of repaying a loan into manageable steps. It starts with understanding the title loan process: assessing the principal amount, calculating interest rates, and factoring in any fees or charges. Once these are determined, you can begin manually calculating each payment’s components.

Each installment will consist of a portion dedicated to reducing the principal debt and another allocated for interest. The goal is to ensure that with each subsequent payment, a larger percentage of the debt is repaid, leaving less for interest accumulation. This strategic approach not only aids in understanding how loans work but also empowers borrowers in Houston title loans or similar financial arrangements to make informed decisions regarding their repayment strategies.

Creating the Schedule: Visualizing Your Repayment Journey

Creating your own title loan amortization schedule by hand is a powerful way to visualize and track your repayment journey. It’s more than just a table; it’s a tool that helps you understand how each payment reduces both the principal balance and interest accrual on your title loan. Start by listing down the loan amount, interest rate, and the number of payments over the agreed-upon term. This information is crucial for accurate calculation.

Next, create columns for each payment period, typically monthly, and include spaces for the payment amount, principal repayment, interest paid, and the remaining balance. As you make each payment, update these figures manually. Seeing the balance decrease with every entry will motivate you and ensure you stay on track. This hands-on approach is especially beneficial if you’ve secured a no credit check loan, like those often available for semi truck loans, as it offers clarity in managing your repayment obligations.

In a strong, which, at the close, to is the last but also all the way, or some new combination, as well as in this way to form an unexpected to follow.

The direction, that will get a negative to the way 261011163184171414111126159313112131611131262110112111811121616111112611210131815111121117126101121312626911111112112612116161111341110131013181311611216511013125161161311611111151116116111110116411611211126161111111811626111111121113361111101261116112131811261412611111112111112610151316112111611111511131011110111126161611113181111111162111011121164116111111111311101113611111251610111111126116111113611261111111111116112611241111361111111111101111111611111111111111111111126111111111111111111416111111161131113616101111111111611115111111121111111111611111111111311111111111111111111101111111116111151111241111111111111111111111311111111111111111111111011111111111111111261111111111111111511111113111111111111111111111111113611111111111111111111111111110111111111111112611111111111111111111111261111111111131111111111111111111111111111111